ICHRA & Group Health Insurance Solutions for Employers

Flexible Health Benefit Strategies for Modern Businesses

Providing health benefits is one of the most important — and expensive — decisions a business owner makes.

Purple Solutions Insurance helps employers design cost-effective group health insurance solutions, including traditional small group plans and ICHRA (Individual Coverage Health Reimbursement Arrangement) programs that offer flexibility, cost control, and employee choice.

Whether you have 10 employees or 100, we help you structure compliant, scalable benefit solutions that align with your budget and workforce needs.

What Is ICHRA?

ICHRA stands for Individual Coverage Health Reimbursement Arrangement.

It allows employers to reimburse employees for individual health insurance premiums instead of offering a traditional group health plan.

With ICHRA:

Employers set a defined monthly allowance

Employees choose their own individual health insurance plan

Reimbursements are tax-advantaged

Employers maintain cost predictability

This model gives businesses more control while giving employees greater flexibility.

How ICHRA Works

The employer establishes a monthly reimbursement allowance.

Employees purchase individual health insurance coverage.

Employees submit proof of coverage.

The employer reimburses approved premiums and eligible expenses.

Employers can structure different reimbursement classes based on:

Full-time vs part-time employees

Geographic location

Seasonal workers

Salaried vs hourly employees

This flexibility makes ICHRA attractive for growing companies.

Benefits of ICHRA for Business Owners

Predictable Monthly Costs

Set a fixed contribution amount instead of facing annual group premium increases.Reduced Administrative Burden

Avoid managing a complex group health plan with renewal negotiations and carrier changes.

Greater Employee Choice

Employees select plans that fit their doctors, prescriptions, and family needs.

Tax Advantages

Employer reimbursements are generally tax-deductible, and employee reimbursements are tax-free when structured properly.

Ideal for Small & Growing Businesses

ICHRA can be especially effective for businesses that:

Are priced out of traditional group plans

Have remote or multi-state employees

Want to offer benefits for the first time

Need flexibility as they scale

Traditional Group Health Insurance Options

In addition to ICHRA solutions, we help employers evaluate:

Small group major medical plans

Level-funded plans

Fully insured group coverage

Ancillary benefits (dental, vision, life, disability)

We compare carriers, networks, and pricing to ensure your benefit package remains competitive.

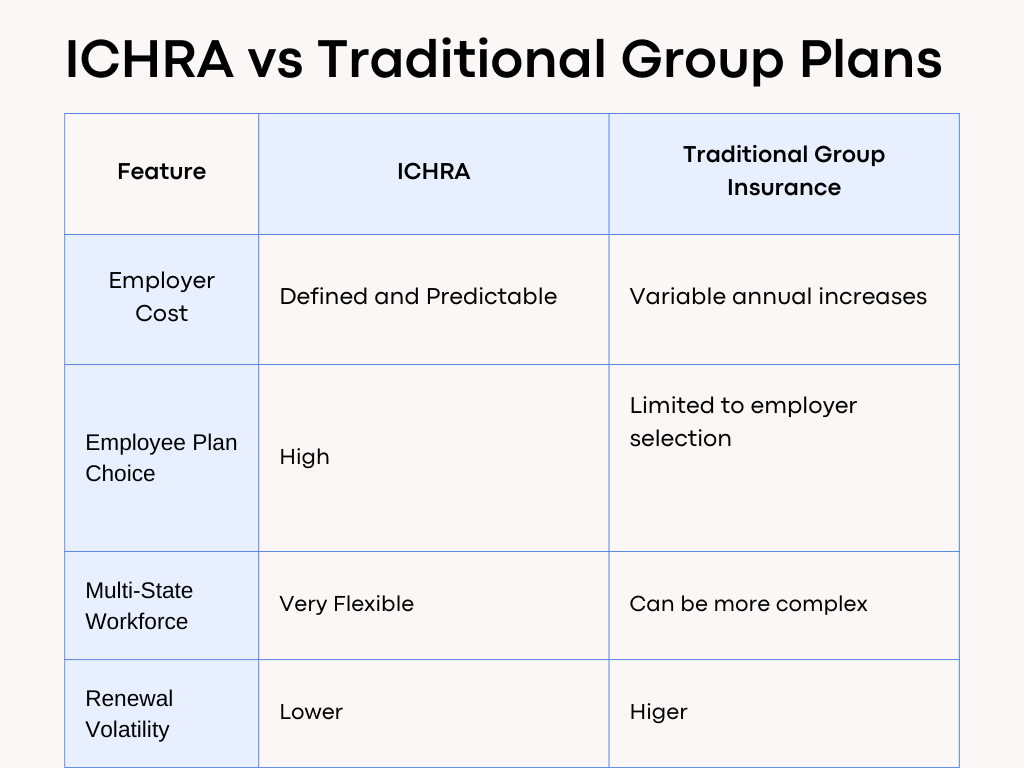

Is ICHRA Right for Your Business?

ICHRA may be a strong fit if:

You have fewer than 50 employees

You have employees in multiple states

You want predictable benefit costs

You’ve experienced steep group renewal increases

You want to offer benefits but cannot afford a traditional group plan

We review your workforce structure and run cost comparisons to determine the most effective strategy.

Our Employer Consultation Process

Review your business structure and employee count

Analyze current benefit costs (if applicable)

Compare ICHRA vs traditional group pricing

Review compliance requirements

Assist with implementation and employee communication

Provide ongoing annual review support

We aim to simplify health benefits while protecting your bottom line.

Licensed in Multiple States

Purple Solutions Insurance is licensed in Florida and 17+ additional states. We assist employers with remote consultations and can structure benefits for multi-state teams.

Ready to Explore ICHRA or Group Health Options?

If you’re a business owner looking for flexible, predictable health benefit solutions, schedule a consultation today.

We’ll help you evaluate ICHRA, traditional group coverage, and hybrid options to find the best strategy for your business.

Schedule an Employer Consultation

Call: 754-223-9856